25 May Federal Direct Pupil Mortgage Entrance Counseling and Grasp Promissory Notes – Faculty Help Professional

[ad_1]

How Do I Finalize My Federal Direct Pupil Mortgage?

At Faculty Help Professional™, we imagine it’s vital that every one college-bound households know that they’re entitled and assured Federal Direct Pupil Mortgage funding to place towards the price of faculty.

If borrowing is in your radar in any respect, we advocate pursuing Federal Direct Pupil Loans (FDSL) previous to taking a look at some other choices. Keep in mind, these are nonetheless loans that may must be paid again. Make certain you perceive and comply with the charges, phrases, and circumstances of ANY mortgage you select. These loans are usually the perfect place to start borrowing for faculty.

Let’s have a look at just a few information in regards to the FDSL program:

- In case your FDSL is a sponsored mortgage, it’s 0% rate of interest whereas the coed is in faculty.

- The mortgage turns into due 6 months after the coed graduates.

- There aren’t any prepayment penalties.

These loans can be found to all college students who’ve accomplished and submitted the FAFSA. They’re designed to be “use it or lose it”. In different phrases, they’re out there for all 4 years of a pupil’s faculty profession, however can’t be leveraged retroactively. A pupil must take out as much as the utmost quantity annually with a purpose to take full benefit of this program.

The loans complete $27,000 over the 4 years of faculty.

Right here’s the utmost borrowing quantity for annually:

- $5,500 Freshman

- $6,500 Sophomore

- $7,500 Junior

- $7,500 Senior

Securing Your FDSL

Many college-bound college students and their mother and father are not sure the way to truly safe their Federal Direct Pupil Mortgage (FDSL) after seeing it on their monetary support award letter. With increasingly faculty college students taking authorities loans out to cowl the faculty funding hole, or pay for a portion of their tuition, the Division of Training requires every pupil to finish two steps:

- Entrance counseling

- A grasp promissory notice

Keep in mind, these loans are solely within the pupil’s identify, there’s NO mum or dad co-signor. That is an settlement between the federal authorities and the coed. The scholar is predicted and required to finish these two gadgets previous to mortgage disbursement.

Let’s dive into what these two “to do’s” are, and why they’re vital.

What Is Entrance Counseling?

Entrance counseling is a REQUIRED a part of accepting an FDSL. It walks debtors (the coed) by the phrases and circumstances of the mortgage, and your rights and tasks.

College students be taught the significance of reimbursement and the implications of failing to repay your mortgage. The counseling discusses how curiosity accrues, and the way it’s capitalized (unpaid curiosity that’s added to your pupil mortgage, rising the entire you repay.) Compensation choices and particular sources out there to you as debtors are additionally defined.

The Division of Training is striving to teach college-bound college students on what it means to take out a pupil mortgage. The federal government needs to be sure you are an knowledgeable pupil mortgage borrower. This counseling have to be accomplished BEFORE receiving your mortgage. The entrance counseling is discovered on the Federal Pupil Help web site.

The scholar, not the mum or dad, completes the counseling and the complete course of takes about half-hour max, however have to be accomplished in a single sitting.

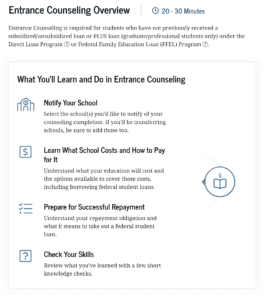

Listed here are the steps to finish your entrance counseling requirement:

- Pupil should login to https://studentaid.gov/

- Choose “Log in”

- Enter STUDENT FSA ID username/password

- Click on “settle for”

- Enter language and e mail choice

- Choose “Full Mortgage Counseling”

- Choose “Entrance Counseling”

- Comply with Directions to finish counseling (~quarter-hour)

Here’s a screenshot from the start of the counseling web page. You’ll stroll by six separate modules: Estimate the Price of Your Training, Paying for Your Training, Federal Pupil Loans, How A lot You Can Count on to Borrow, Put together for Compensation After Faculty, and Penalties of Not Repaying Your Pupil Loans

Why Is Entrance Counseling Necessary?

If you’re a college-bound pupil, or your youngster shall be going to high school this upcoming enrollment season, entrance counseling might really feel like a irritating further step to getting the funding you’re assured by the US Division of Training.

Nevertheless, this can be a unbelievable opportunity to teach your self about what your federal loans entail, and what’s required of you after commencement for reimbursement. Too usually, faculty college students are stunned by their mortgage reimbursement when it comes due, and this can be a good way to make sure that you’re empowered with data on what’s anticipated of you post-graduation.

What’s a Grasp Promissory Word (MPN)?

A Grasp Promissory Word (MPN) is the second requirement new debtors should full earlier than loans are disbursed. It is a authorized doc that has debtors promise to repay their pupil loans (and accrued curiosity and/or charges) again to the Division of Training. It additionally explains the total phrases and circumstances of your mortgage.

Promissory notes will not be unusual on the earth of lending. Usually, debtors shall be required to signal a promissory notice for different massive loans comparable to a mortgage. Have a look at this like your precise pupil mortgage utility.

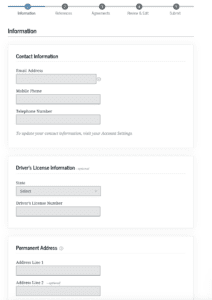

You’ll fill out three separate sections on the MPN.

First is the Data part.

This part contains fundamental contact data, driver’s license data (non-obligatory), and everlasting and mailing handle data, and the varsity you’ll be attending.

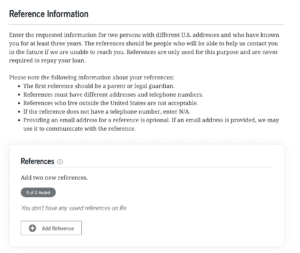

The second part is the Reference part.

You’re required to have two references on your MPN. They have to reside within the U.S., have totally different addresses and phone numbers, they usually should have recognized you for at the very least three years. The primary reference needs to be a mum or dad or authorized guardian.

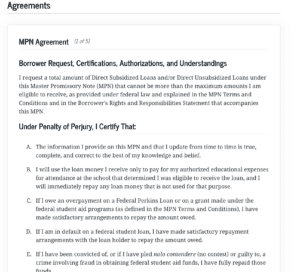

The third part is the Agreements part.

That is the place you might be agreeing to all of the phrases and circumstances of the Federal Direct Pupil Mortgage you might be making use of for.

Listed here are the steps to finish your MPN:

- Choose “Full Mortgage Settlement (Grasp Promissory Word)”

- Choose “MPN for Sponsored/Unsubsidized Loans”

- Comply with directions to finish settlement (~5 minutes)

Why Is a Grasp Promissory Word Necessary?

Your Grasp Promissory Word is a spot the place you’re promising to pay again your pupil mortgage – full with curiosity and costs – to the Division of Training. Though that is commonplace apply, it’s vital to remember that this can be a legally binding doc. Earlier than borrowing, be sure you perceive what you owe and what’s required of you upon commencement.

A couple of issues to recollect when taking out a pupil mortgage. Loans are a authorized obligation and you might be answerable for repaying the quantity you borrow plus any accrued curiosity. Even in the event you don’t start repaying your mortgage till you graduate from faculty, it’s vital to know and perceive all of your tasks as a borrower, and the way NOT following by with these tasks might adversely have an effect on you.

[ad_2]